SIP Calculator Nepal is an online tool that helps to calculate the expected returns on your investment plan. With this tool, you will be able to get an idea of the investment you made over a period of time with the dynamic rate of return.

This SIP Return Calculator helps to calculate your expected returns on your investment plan that you set for a no. Of years. Here’s the most flexible and easiest SIP Goal Calculator for you. You can calculate your return by entering the amount that you want to invest, investment tenure, and expected return on your investment.

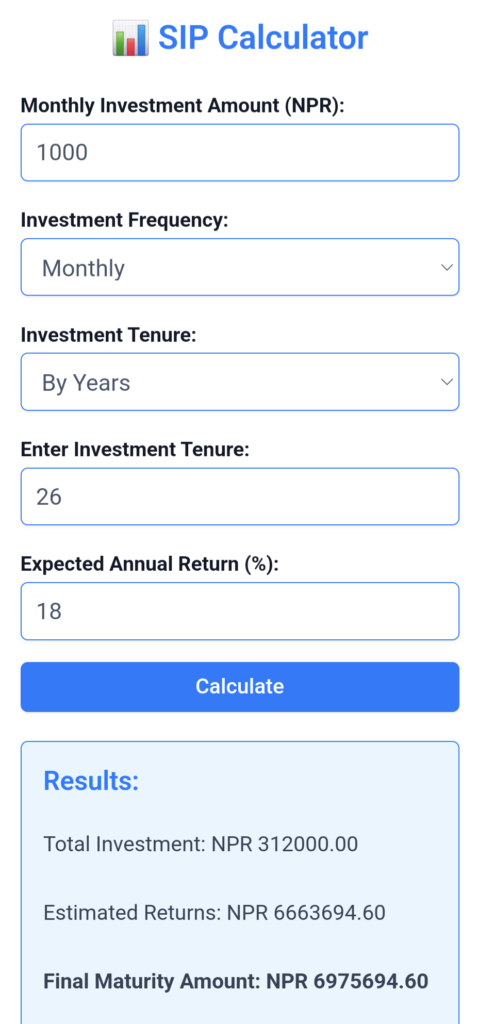

📊 SIP Calculator

Disclaimer: This SIP Calculator doesn't represent the actual returns on your investment. This calculator only calculates the expected return that you get in the given period and the rate of return you entered. We need to be clear that mutual funds don't have a fixed rate of return, and not possible to predict the rate of return.

*Mutual fund (SIP) investments are subject to market risks. Please read the prospectus carefully before investing in SIP.

What is an SIP Calculator?

SIP (Systematic Investment Plan) calculator is a simple financial calculator that helps to calculate the estimated return of the investment made by the investors on the mentioned period with an expected rate of return. This tool helps to calculate the returns of the amount that you will get while investing in this SIP Plan.

You can calculate the SIP Return easily by entering your monthly investment amount, tenure (the Year or month), and the expected return on it.

How to Calculate SIP Return using SIP Calculator Nepal

Our SIP Return Calculator is easy and effective. You can easily start calculating the SIP Return using our SIP Calculator.

- Enter the amount that you want to invest monthly.

- Select the investment frequency; based on your requirement, you can choose (Monthly, Quarterly, Semi-Annually, and Annually). To better set the Investment frequency to Monthly.

- Choose the investment tenure either by Months or Years. Choose By Year for the best and easy process.

- Enter the Investment tenure (Either by Year or Month)

- Enter the Expected Annual return (%) in your investment.

- Tap/click on calculate.

For example,

Monthly Investment Amount: Rs 1000

This is the amount that you have to invest monthly (every month)

Investment Frequency: Monthly

This is the frequency that you have to choose to invest. If you choose 'Monthly,' then you have to invest Rs 1000 each month.

Investment Tenure: By Years

If you set the investment frequency to by 'year' then it's easy for you.

Enter Investment Tenure: 26 Years

This investment tenure means the no. Of years you want to invest. In this example, we have set it to '26', which means we are planning to invest or check the return of 26 years.

Expected Annual Return (%): 18%

This is the assumption that we get a return from the mutual fund company on average for each Year. This may not be the same and subject to market state. Here, for reference, we have set it to 18%.

Screenshot

Results Meaning in our SIP Calculator:

Total Investment: This is the total amount that you will pay in this whole process. It's your total investment that you have to pay in this whole SIP Process.

Estimated Returns: This is the expected returns or profit (in General) that you will get on your investment. These estimated returns differ based on your investment period (investment years) and expected annual return.

Final Maturity Amount: The total amount (Total Investment + Estimated Returns) is called the final maturity amount. This is the total amount receivable after the maturity of your investment plan.

What is SIP?

SIP stands for Systematic Investment Plan. It's an Open-end mutual fund that doesn't have any maturity period. This is the investment route offered by Mutual funds where one can invest a fixed amount on a regular basis. It's one of the most popular investing schemes that helps in investing in a disciplined manner without worrying about the volatility of the market.

This investment plan is really systematic as it follows the compounding process.

Note: As with other equity and mutual funds, the units of SIP (Open End Mutual Fund) are also shown in the portfolio section of MeroShare.